[nectar_dropcap color=”#0071bc”]O[/nectar_dropcap]ne of the determining factors of the Reserve Bank to keep interest rates on hold at 2.25% are no doubt the growing concerns over the rising home prices in Australia. The rapid rise in property prices during the last 12 to 18 months could have the potential to lead to a housing bubble.

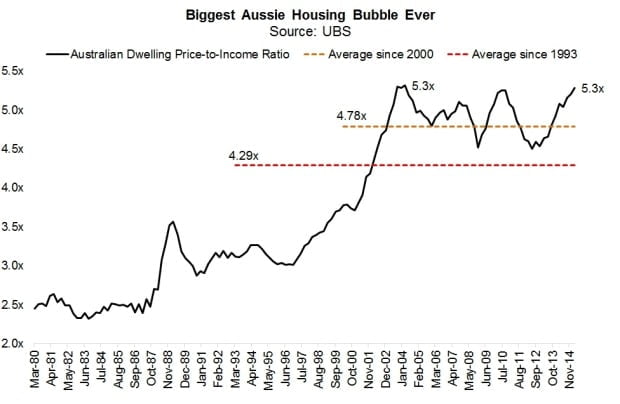

As the chart below illustrates, we are paying far more for housing than at any time in the past 35 years.

Source: Australian Financial Review & UBS

Debate is rife as to whether the ‘property bubble’ is reaching dangerous territory. The fact remains that if it does burst….there will be many, many property investors in a lot of trouble.

Consider also that Australia may be in the midst of a perfect storm. At the time of writing iron ore prices were below $50 per ton, and falling with some forecasters suggesting prices as low as $20, spelling deep trouble for our mining industry.

We also note that in Corporate Australia, in the non-mining sector, profits are also under pressure and are being revised downwards. Interest rates are at record low levels, not by coincidence but because our economy is not exactly healthy at the moment and requires stimulation. It must be noted therefore that if global economies were strong and growing, then interest rates would be higher.

But there is the rub. In an effort to encourage business investment and consumer spending, falling interest rates have instead created an almost unprecedented property splurge.

Perhaps it is therefore that an unintended consequence of low interest rates is the attractiveness of ordinary Australians to borrow money in ever-increasing amounts to fund the purchase of residential property.

It has been clear since the mid-1990’s that Australian home buyers and investors have adopted a strategy of borrowing heavily from lenders, then flipping houses to the next buyer who has an even bigger debt to meet.

Unfortunately it is young home buyers and middle income earners who find themselves either stretched to the limit or completely priced out of the property market altogether. Many home buyers in Australia’s capital cities are taking on ridiculous amounts of debt to enter the housing market and are being allowed to do so by our over-leveraged banking system.

Perhaps then one of the catalysts for the decline of property prices will be an increasing unemployment rate in a softening economy. Some economists believe that Australia is on the cusp of a recession.

In fact property prices have already crashed across our mining towns, with falls of up to 40% not uncommon. The dramatic slowdown in the mining sector will cause effects across the whole of Australia.

There are usually no warning signs to the ending of the bubble, however hindsight will often show the signals that were present. It only takes one domino to fall to begin the beginning of the end of the bubble.

Of course our capital cities are a far cry from distant mining towns, however this is a perfect demonstration of when demand disappears from a market, prices soon follow suit.

If you are considering entering the property market at this time, then it is now more than ever that you should be taken into account factors that would hold your property in good stead during any downturn in the property market. Just like during a share market crash where some companies fare much better than others, so too is this true for property.

Just because you own bricks and mortar does not make a property immune to a downturn, prices can and do fall. It is during these times that you will benefit from a well thought out property purchase that takes into account a number of considerations.

The most important rule when it comes to investing, whether property or shares is to avoid buying overpriced assets, because this usually results in permanent capital loss. True we may well be in the midst of a property bubble but that does not necessarily mean property in of itself is a poor investment at this time, it just means more research is required before a purchase decision is made.

Sadly not much is being done by economists, politicians and regulators in Australia to stop the debt-fuelled property demand. In fact in some cases they have created opportunity such as housing grants and the allowance of retirees to tap into their life savings.’

If the so called property bubble were to burst, some investors will no doubt be will be hit hard. Rental returns will drop but mortgage payments won’t. It is during these times that people often find themselves with black marks against their credit report due to increasing difficulties in meeting repayments.

Often people in financial difficulty fail to make one or more repayments on their mortgage, thinking that they will be able to make it up later. This is quite often not the case, and they often find themselves in a downward spiral.

Having a clear plan that includes a strongly adhered to budget helps you analyse where your money is spent. Tracking purchases and expenses helps to identify where the biggest savings can occur, make repayments and ultimately better financial decisions for your future. In some cases this may include refinancing or consolidation of debt, creating a single repayment for all debt.

Sound financial advice is essential in times of a turbulent economy to ensure you are not only able to meet your obligations, but also to future proof your finances.

For more information contact Andrew Rowan on 5331 6550 or email andrew@arwm.com.au

Sources: