If you’ve been observing the news over the last couple of days, you could be forgiven for thinking there was a major catastrophe underway. A quick scan of the news provides for the following headlines;

- $85 billion stripped from the value of Aussie sharemarket

- Global sharemarket rout

- Bloodbath

- Stock market dives

- Sharemarket turmoil

- Stock market a lot like bitcoin (go figure on that one)

As Donald Trump would say, “Fake News.”

So what really happened?

It’s important to understand what has been happening in global financial markets (including a property market) over the past few years. As we have repeatedly reported, low-interest rates have driven inflated asset prices.

As interest rates fall, the price of assets increases because investors are prepared to pay more for risk to achieve a better return than the risk-free rate of return, which is effectively the interest rate on defensive assets (safe) investments, such as cash, or bonds.

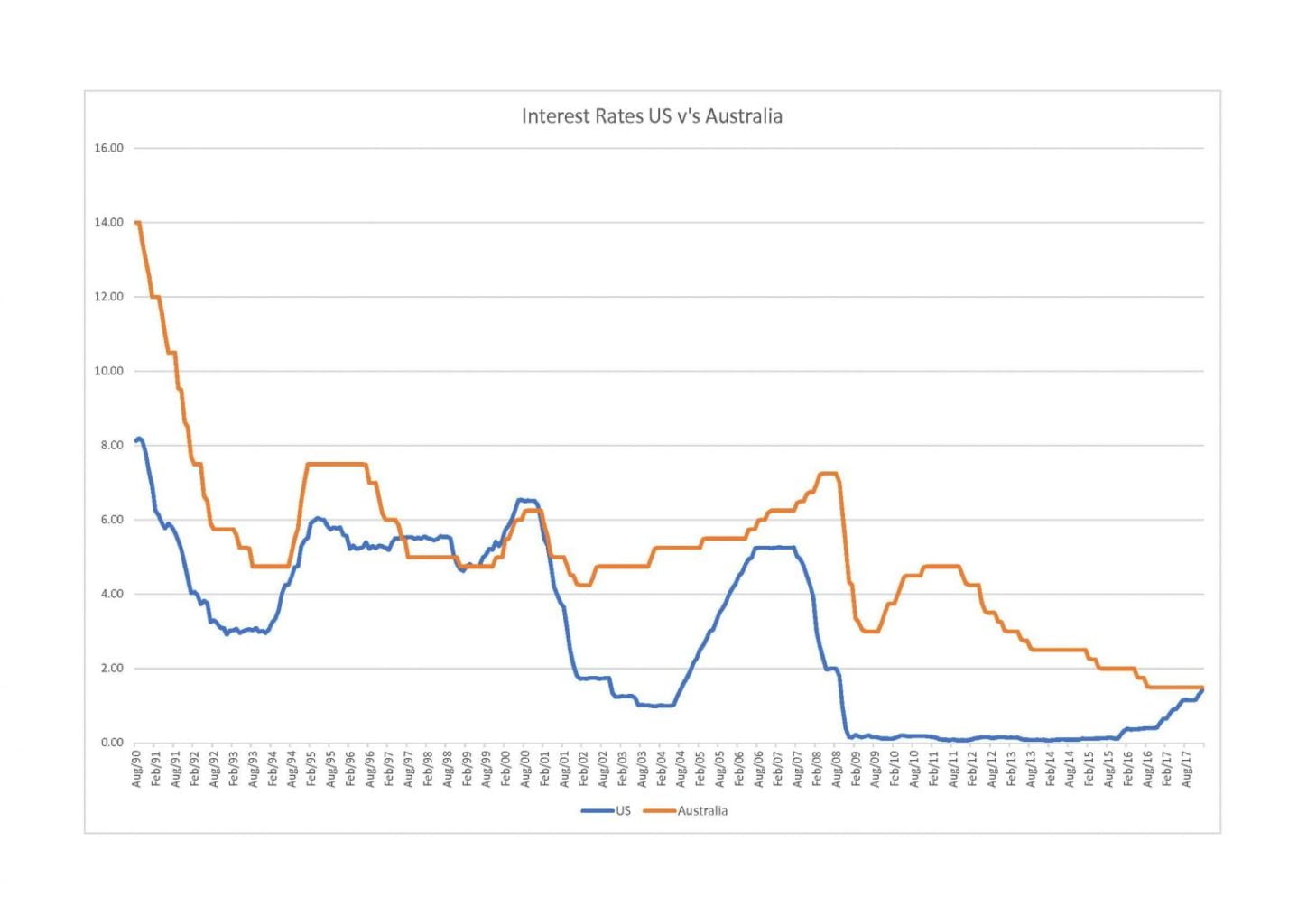

As can be seen in the chart below interest rates have been steadily falling for 30 years. The orange line is representative of Australian interest rates, with the blue line interest rates in the US. Since 2009 interest rates in the US were close to zero, and during this time the sharemarket has recorded large gains, however since early 2016 (rates) have gradually risen. The prospect of higher rates is now causing investors in the US to re-assess their investment options. For the corresponding period rates in Australian fell, which has also resulted in a buoyant sharemarket here.

The situation now is such that over the course of this year we are likely to see higher interest rates in the US, than here in Australia. A higher US interest rate setting has only occurred once in the last 30 years, during the latter part of the 90s.

Higher rates in the US then sets the scene for the Reserve Bank to begin increasing rates here.

Going forward the implications for higher interest rates are that we would expect share markets to adjust to the changing landscape.

That is to say that if people can obtain a higher risk-free rate of return, they will, in turn, expect to pay less for riskier investments, such as shares and property.

So it’s no surprise that as interest rates fall, asset prices increase as they adjust to the new lower interest rates, so it follows that when interest rates rise, asset prices adjust by falling in value.

In the short-term, this likely means volatility, and days or weeks even of falling prices as markets re-set.

It would be great if these things happened uniformly, however, in any market, there is a tendency for them (the market) to swing through cycles because at any given time investors are either optimistic or pessimistic.

So while people read the news and worry over the headlines, it is worth noting that the US sharemarket has increased over 350% in the last nine years, with the Australian market up 194% over the same period. Over the last 12 months the US market increased by 28%, and the Australian market up around 8.5%. Not that those returns make for attention-grabbing headlines.

So, when optimism turns to pessimism, and back to optimism again today, this is no cause for concern. It is rather merely the market doing what markets do, going up and down in value based on the sentiment of the participants in the market at that time.

We expect that the US market is likely to correct further, or at least slow down given our view that the market there is (or approaching) fully priced territory. It is also true that rising interest rates are an indication of a strong economy, and all indicators in the US are that their economy is ticking along quite well at the moment. Rising interest rates have been foreshadowed now for some time, and so not unexpected.

In Australia, our market is still considered fair value, which says that from any immediate reaction to market movements in the US, our market would be expected to rebound.

It would not be unexpected to see some market volatility both here and globally through 2018, as the world adjusts to an increasing interest rate cycle in the US. That this occurs is the normal course of the cyclical nature of financial markets, and certainly not newsworthy to the degree that media outlets would have you believe.

It really staggers me that news outlets devote such time to these headlines. However, I guess nothing grabs someone’s attention more than the thought that they are losing money. They (the media) are after all in the business of trying to coerce us (the public) into paying attention to them.

So, as Mark Twain (allegedly) once said, “never let the truth get in the way of a good story.”

Of course, if you have any concerns about the impact of financial market volatility on your investments, or superannuation, please feel free to give us a call.